Maximize Your Opportunities Under the New Republican Tax Law?

When talking about the Republican Tax law, Americans have mixed emotions and reactions. The said new tax bill changes the fundamental state of the tax law. Not only it affects the business sector, but every American worker gets affected by it too.

The good news though is that not everything inside the 512-pages bill is set to be implemented this year. Some of the provisions written will only take effect when you, as a U.S. citizen, start filing your tax return in 2019. The question is, can you make the most of the new federal tax law and save a few bucks from the deduction cuts? Well, we think so!

Give Some of Your Money to Charities

The key to increasing your potential deductions is to give out your money to charities before you set to file your tax return in 2019. Yes, you can still do that even if we’ve already entered 2018. You need to donate your money to charitable institutions to boost your deduction claim. Why? It’s because you can eventually claim these deductions, including charities, after you itemize your tax return.

George Dolgikh / Shutterstock

Defer Your Income

This recommendation is more appropriate for business owners and investors. Aside from lower corporate taxes, they can delay the filing of their income until next year. This will allow the businessmen to lower their April tax bill. If you’re an investor, you can also start selling your stocks in advance to lower your taxable income. If not, you have the option to wait until the second half of 2018 to sell your winning stocks.

Try to be mindful. Deferring your income only means delaying on paying your inevitable taxes. But, if you believe that your income tax rate might decrease the following year, then, deferring your money can let you save more bucks in the process.

Pay Your Taxes in Advance

fizkes / Shutterstock

The new law also limits your standard deduction of state and local taxes (SALT). Currently, it only allows you to have $10,000 deductions from your combined sales or income taxes. That’s why most financial experts advise their clients to pay their next year’s taxes in advance before the filing date arrives in April. This enables you to save more money since the law for pre-payed taxes is still covered by the old rules.

Record Your Work-Related Expenses

Olga Pink / Shutterstock

Before, an employee was able to file deductions on his/her unreimbursed expenses as long as it was standing above the 2% threshold of their income. However, the new tax law no longer includes these deductions starting next year.

Few examples of unreimbursed expenses are office tools and supplies, work uniforms, occupational taxes, union dues, and work-related travel expenses. That’s why it’s imperative that workers should pay for these work-related expenses and get their receipts so that their employers can reimburse it.

Move Out ASAP

If your work requires you to move to another place or state, then you might plan your move ahead of time rather than delaying it. Why? According to the new tax law, you will no longer be able to deduct your work-related moving expenses, unless you’re working in the military. That’s why, it is best to schedule your moves in advance and as soon as possible.

More in Legal Advice

-

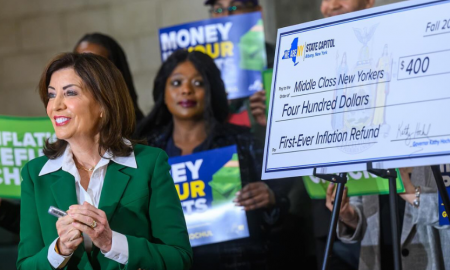

New York to Mail Out One-Time Inflation Rebates. Here’s the Eligibility List

New York is preparing to send out its first-ever inflation refund checks, providing financial relief to millions of residents as prices...

October 3, 2025 -

Here’s What Artists Should Know About Copyright & Its Implications

Copyright protects your art from the moment you create it. The second your drawing, painting, sculpture, or photo is fixed in...

September 27, 2025 -

Everything to Know About Vogue America’s New Editor, Chloe Malle

Chloe Malle just stepped into one of the most powerful roles in fashion media: Head of Editorial Content at Vogue America....

September 21, 2025 -

Did Barron Trump Apply to Harvard? Clearing Up the Rumors

Speculation often swirls around public figures, and in recent months Barron Trump’s college choices became part of the conversation. Questions surfaced...

September 20, 2025 -

Can You Be Naked in Texas?

The Texas public nudity law isn’t as simple as “no clothes, you are in trouble.” It all comes down to intent,...

September 13, 2025 -

Why AI Is Now a Necessity, Not a Choice, for Law Firms

Artificial intelligence is no longer a futuristic concept for the legal industry. It is steadily changing how law firms operate, not...

September 13, 2025 -

Waikiki Lifeguard Cleared in Confrontation With Notorious Criminal

On a hot day at Kuhio Beach, veteran lifeguard Christopher Kekaulike Kam stepped in when things got out of control. A...

August 13, 2025 -

Gawking at the Coldplay ‘Kiss Cam’ Affair Is Voyeurism at Its Worst!

Coldplay concerts are meant to be joyful. But during a recent show, a playful kiss cam bit turned into a public...

August 6, 2025 -

Essential Safety and Success Resources for Trans Journalists

Trans journalists go through tough spaces every day. In a field that often tests your limits, knowing where to turn for...

July 30, 2025