Worried About Your Mortgage Payments? Experts Claim These Tips Might Solve Your Problem

The COVID-19 pandemic continues to raise towers of problems for all of us alike. With companies laying off thousands of employees to businesses shutting down, none of us have it easy. As a result, thousands of unemployed people continue to scuffle to make ends meet. Many of us have found bills piling up on our tabletops, the biggest of which is our home mortgage.

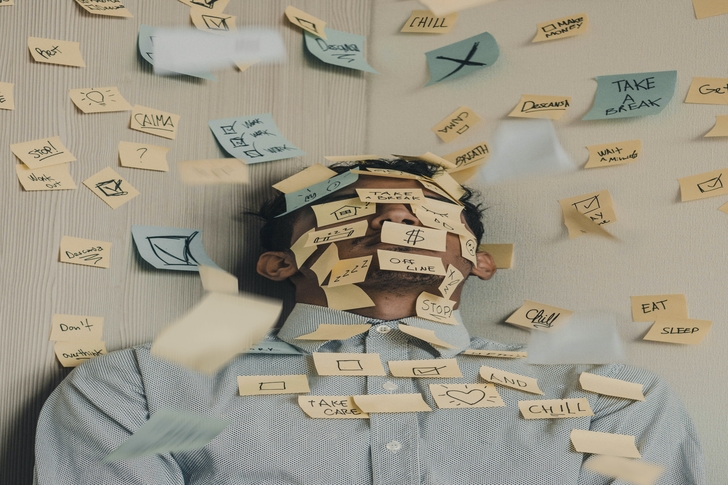

Unsplash | We are all buried under towers of responsibility

Well, we’ve gathered this data from experts who might help you solve your problem. Here’s how you can try to keep afloat in such deep waters while suffering the brunt of a pandemic.

Communicate, communicate, communicate

Unsplash | In every situation, communication is key

And this is coming from a representative of Guild Mortage’s Mountain. Mike Querry says that the first thing those of us struggling financially should do is contact your lender. This opinion is shared by the vast majority of mortgage companies.

Your lender will accommodate you in the form of forbearance. This will, therefore, defer the month’s payment. However, this step does not automatically wipe your problem from the face of the Earth. Instead, you will be granted some time to pay the deferred payments. You can choose to pay them later in a lump sum or over a pre-decided period.

Forbearance is a short-term solution

As mentioned before, your problem won’t simply vanish once you apply for forbearance. You will, in fact, have to deal with it eventually. Hence, it is best not to consider this unless it is ABSOLUTELY NECESSARY. Many people are putting off their mortgage payments, despite being perfectly able to do pay it.

Remember, even though forbearances do not appear on your credit card statements, you will be questioned whenever you apply for a mortgage in the future. Moreover, it will continue to lurk in the corners for a long time, until you pay it off.

Unsplash | Don’t make mistakes that result in you losing your home

Try digging into those retirement funds

Another representative, Brandon Rizk, who works as a branch manager at Planet Home Lending suggests that now might not be a bad idea to tip into your retirement funds if you need to pay off your mortgage.

Additionally, retirement account agencies are currently charging no penalty for withdrawing from your account. However, you must return the borrowed amount to the agency within a pre-decided period.

Rizk also adds that it would be unwise to put your mortgage payment on your credit card as there remains a solid chance that you’ll never be able to pay it off. Under ordinary circumstances, borrowing from relatives might have been an option. However, unfortunately, the pandemic has left little room for a vast majority to help people out.

More in Legal Advice

-

New York to Mail Out One-Time Inflation Rebates. Here’s the Eligibility List

New York is preparing to send out its first-ever inflation refund checks, providing financial relief to millions of residents as prices...

October 3, 2025 -

Here’s What Artists Should Know About Copyright & Its Implications

Copyright protects your art from the moment you create it. The second your drawing, painting, sculpture, or photo is fixed in...

September 27, 2025 -

Everything to Know About Vogue America’s New Editor, Chloe Malle

Chloe Malle just stepped into one of the most powerful roles in fashion media: Head of Editorial Content at Vogue America....

September 21, 2025 -

Did Barron Trump Apply to Harvard? Clearing Up the Rumors

Speculation often swirls around public figures, and in recent months Barron Trump’s college choices became part of the conversation. Questions surfaced...

September 20, 2025 -

Can You Be Naked in Texas?

The Texas public nudity law isn’t as simple as “no clothes, you are in trouble.” It all comes down to intent,...

September 13, 2025 -

Why AI Is Now a Necessity, Not a Choice, for Law Firms

Artificial intelligence is no longer a futuristic concept for the legal industry. It is steadily changing how law firms operate, not...

September 13, 2025 -

Waikiki Lifeguard Cleared in Confrontation With Notorious Criminal

On a hot day at Kuhio Beach, veteran lifeguard Christopher Kekaulike Kam stepped in when things got out of control. A...

August 13, 2025 -

Gawking at the Coldplay ‘Kiss Cam’ Affair Is Voyeurism at Its Worst!

Coldplay concerts are meant to be joyful. But during a recent show, a playful kiss cam bit turned into a public...

August 6, 2025 -

Essential Safety and Success Resources for Trans Journalists

Trans journalists go through tough spaces every day. In a field that often tests your limits, knowing where to turn for...

July 30, 2025