Worried About Your Child’s Future? Here Are Some Financial Tips You Should Start Passing On Today

Arguably, financial knowledge is perhaps the most important thing that we need to have an adequate understanding of. Still, schools tend to overlook its importance and never teach our children about financial skills.

As a parent, you’d want nothing but the best for your child. Financial independence, moreover, is something that you’d want them to have. Therefore, it is your job to teach them the necessary financial skills. Schools aren’t going to change overnight, so you need to put in the extra effort.

Unsplash | Parents want nothing more than to see their children happy

New York Times bestseller, Beth Kobliner, the author of Get a Financial Life, makes pretty interesting observations in her book. She says that from the Subprime mortgage crisis which led to 3.9 million foreclosures, to the trillions of dollars owed in student debt, to the hundreds of millions owed in credit card debt, adults don’t know much about finances. Why? Because no one bothered to teach them. So, they only learned when it was too late. They learned from experiences after they suffered their due diligence.

As a parent, your responsibility is to ensure that you teach your children from your mistakes. This doesn’t mean they won’t be making mistakes of their own. But, they will make a lot fewer mistakes than you did, due to the financial skills that you instill in them.

Without further ado, let’s get into the top 5 financial skills that you can pass on to your children.

1. Start Saving When You Start Earning

Most teens and adults who newly start earning tend to spend their entire income every month. Saving? That’s for losers. A big part of being young is living in the moment. You need to teach your child the importance of saving up at least 10% of their income. Also, advise them to spend less than they earn.

Unsplash | Teach your children the importance of saving as soon as they start earning

Rainy days come unannounced and you never know when you might need to spend a hefty amount. Having money saved up will help them not take loans that they might have a hard time paying off. Remind them that once they save enough, they can always spend it on something bigger that is also worth their money—for example, a vacation or a new car.

2. Look For Quality Investments

Long-term financial planning is really important in today’s day and age. With the uncertainties that come knocking at our door at the most inconvenient of times, it is wise to have something saved up on the side. Advice your children and teach them about how to research on quality investments. Investments that are worth their time will always give you good value for your money, a reasonable return, and will be tailor-fit to their requirements.

3. Don’t Be Careless With Your Money

In other words, advise them on how to protect their hard-earned money. Leaving it lying around the house is always a bad option. In fact, as soon as your child is old enough, you should aid them in opening up a bank account.

Unsplash | Creating a bank account for your kid will help develop the habit of saving their money

This will create a habit for them to store their money in a safe place. When their money is in the bank, they will also be able to learn how to manage it effectively. They will avoid making unnecessary purchases, which will translate into a good habit in the long-term.

More in Criminal Attorney

-

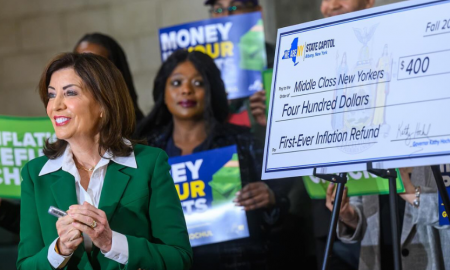

New York to Mail Out One-Time Inflation Rebates. Here’s the Eligibility List

New York is preparing to send out its first-ever inflation refund checks, providing financial relief to millions of residents as prices...

October 3, 2025 -

Here’s What Artists Should Know About Copyright & Its Implications

Copyright protects your art from the moment you create it. The second your drawing, painting, sculpture, or photo is fixed in...

September 27, 2025 -

Everything to Know About Vogue America’s New Editor, Chloe Malle

Chloe Malle just stepped into one of the most powerful roles in fashion media: Head of Editorial Content at Vogue America....

September 21, 2025 -

Did Barron Trump Apply to Harvard? Clearing Up the Rumors

Speculation often swirls around public figures, and in recent months Barron Trump’s college choices became part of the conversation. Questions surfaced...

September 20, 2025 -

Can You Be Naked in Texas?

The Texas public nudity law isn’t as simple as “no clothes, you are in trouble.” It all comes down to intent,...

September 13, 2025 -

Why AI Is Now a Necessity, Not a Choice, for Law Firms

Artificial intelligence is no longer a futuristic concept for the legal industry. It is steadily changing how law firms operate, not...

September 13, 2025 -

Waikiki Lifeguard Cleared in Confrontation With Notorious Criminal

On a hot day at Kuhio Beach, veteran lifeguard Christopher Kekaulike Kam stepped in when things got out of control. A...

August 13, 2025 -

Gawking at the Coldplay ‘Kiss Cam’ Affair Is Voyeurism at Its Worst!

Coldplay concerts are meant to be joyful. But during a recent show, a playful kiss cam bit turned into a public...

August 6, 2025 -

Essential Safety and Success Resources for Trans Journalists

Trans journalists go through tough spaces every day. In a field that often tests your limits, knowing where to turn for...

July 30, 2025