Want to Retire a Millionaire? Here are Three Investing Tips You Should Live by Today

Retiring with millions in your savings and investment accounts is a dream that not many would get to live. That shouldn’t deter you from shooting for the stars though.

Take inspiration from writer Eric Rosenberg’s grandfather, a retired business school professor who put his learnings to work and retired with a portfolio balance of over $1 million.

Here are three things you can do today to boost your long-term investment results.

Do Your Research

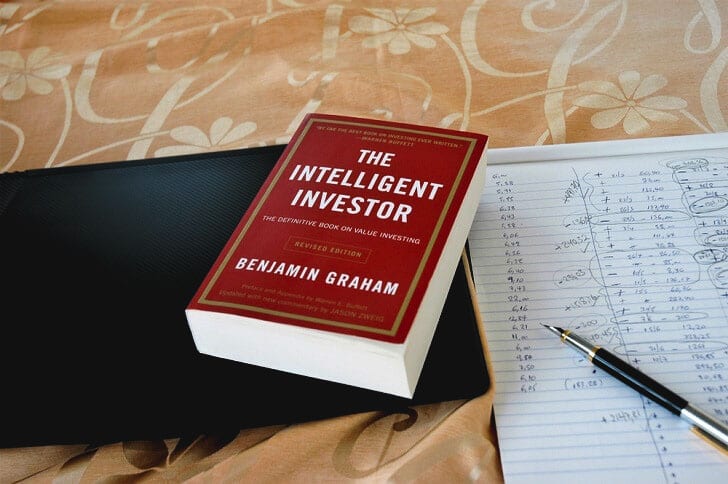

Arhelaos/Shutterstock: Benjamin Graham’s ‘The Intelligent Investor’ remains to be one of the most popular guides on investing until today

Rosenberg learned from his grandfather how important it is to understand the companies behind the stocks he buys. Thus, he wouldn’t pick stocks based on just market trends.

While prices tend to go up and down often, it is a company’s total intrinsic value that determines its stock’s value. His grandfather made a habit of studying a company’s revenue and profit trends before buying into it.

The good news is that you don’t need a degree in business to do this, too. As long as you understand how a certain company has been performing or how it makes money, you can make informed decisions about your investment portfolio.

Monitor Your Investments

Bro Crock/Shutterstock: You can now easily check on your portfolio through your broker’s mobile app

Rosenberg shares memories of coming with grandfather to the bank so he could look up stock prices and track his portfolio’s performance.

While the Internet has made this task much easier these days, the thought behind it remains the same. Knowing the value of your holdings would help you make decisions about which stocks you might want to let go and which ones you need to hold onto.

This applies even if you’re practicing the buy and hold strategy as some stocks’ performance justify selling them earlier than you initially planned.

Keep Track of Your Spending

Rawpixel.com/Shutterstock: Being mindful of your spending would give you more money to invest

Investing more increases the returns you’ll get in the long run. Rosenberg’s grandfather certainly knew this and made it a mission to spend every dollar thoughtfully.

Even though he had the money to splurge on material things, he chose to build his wealth through investing his extra resources.

He encouraged Rosenberg to do the same by giving him an accounting ledger notebook when he was eight years old. Using the notebook, he taught the author to keep track of the money he made and spent, a lesson Rosenberg found handy when he started building his portfolio, too.

While not all of us are as lucky as the author to have a finance-savvy grandfather, you can take these investing lessons from Rosenberg’s grandfather and get on track to retire a millionaire someday.

More in Legal Advice

-

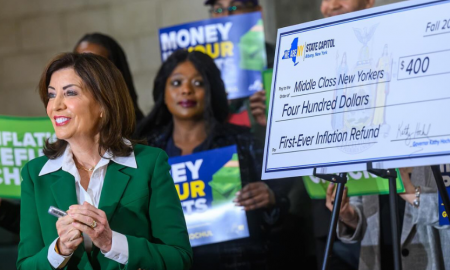

New York to Mail Out One-Time Inflation Rebates. Here’s the Eligibility List

New York is preparing to send out its first-ever inflation refund checks, providing financial relief to millions of residents as prices...

October 3, 2025 -

Here’s What Artists Should Know About Copyright & Its Implications

Copyright protects your art from the moment you create it. The second your drawing, painting, sculpture, or photo is fixed in...

September 27, 2025 -

Everything to Know About Vogue America’s New Editor, Chloe Malle

Chloe Malle just stepped into one of the most powerful roles in fashion media: Head of Editorial Content at Vogue America....

September 21, 2025 -

Did Barron Trump Apply to Harvard? Clearing Up the Rumors

Speculation often swirls around public figures, and in recent months Barron Trump’s college choices became part of the conversation. Questions surfaced...

September 20, 2025 -

Can You Be Naked in Texas?

The Texas public nudity law isn’t as simple as “no clothes, you are in trouble.” It all comes down to intent,...

September 13, 2025 -

Why AI Is Now a Necessity, Not a Choice, for Law Firms

Artificial intelligence is no longer a futuristic concept for the legal industry. It is steadily changing how law firms operate, not...

September 13, 2025 -

Waikiki Lifeguard Cleared in Confrontation With Notorious Criminal

On a hot day at Kuhio Beach, veteran lifeguard Christopher Kekaulike Kam stepped in when things got out of control. A...

August 13, 2025 -

Gawking at the Coldplay ‘Kiss Cam’ Affair Is Voyeurism at Its Worst!

Coldplay concerts are meant to be joyful. But during a recent show, a playful kiss cam bit turned into a public...

August 6, 2025 -

Essential Safety and Success Resources for Trans Journalists

Trans journalists go through tough spaces every day. In a field that often tests your limits, knowing where to turn for...

July 30, 2025