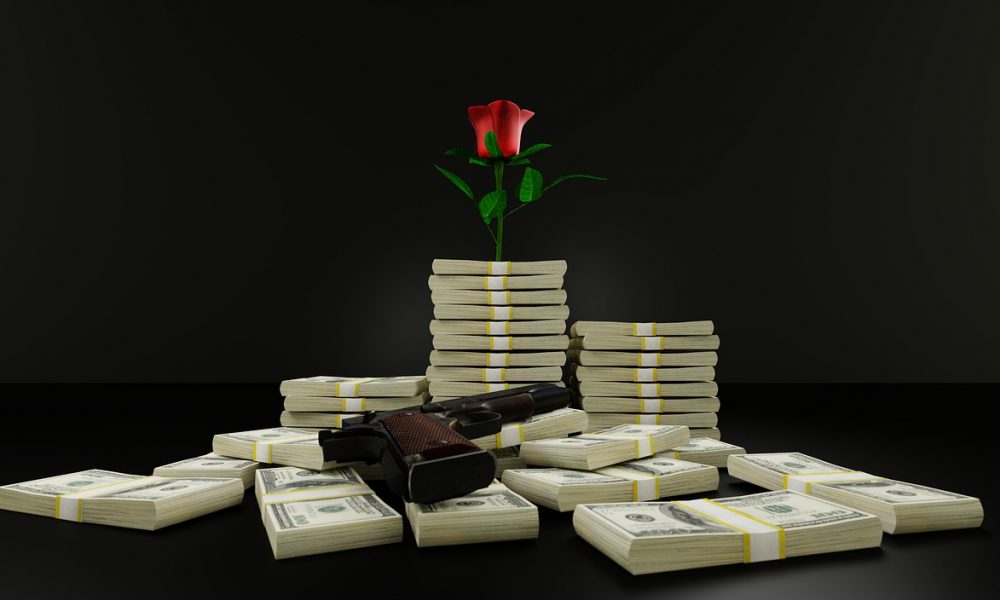

Recovering Funds From Wire Transfer Fraud in White Collar Crime Cases

Wire transfer fraud is a serious white-collar crime that affects many people every year. Scammers use wire transfers to steal money from unsuspecting victims in the U.S. and around the world. In 2020, the FBI received 467,361 complaints of internet crime, with reported losses of over $4.2 billion.

Wire fraud in real estate is particularly on the rise, with scammers impersonating real estate agents, title companies, and other trusted third parties to trick people into wiring money into fraudulent accounts.

If you are a victim of wire transfer fraud, you may be wondering if you can still recover your funds. In this article, we will discuss what wire transfer fraud is, how it works, and what you can do to recover your money.

US Weekly / Last year, the FBI received 467,361 complaints of internet crime, with reported losses of over $4.2 billion.

What Is Wire Transfer Fraud?

Wire transfer fraud is a type of online scam in which fraudsters trick victims into sending money to them through a wire transfer. They use various tactics, such as phishing emails, fake online stores, and social engineering, to gain victims’ trust and obtain their bank account or credit card information.

Once they have the information of the victim, they create fraudulent wire transfer requests, instructing the victim’s bank to transfer funds to the fraudsters’ accounts.

How Does Wire Transfer Fraud Work?

Wire transfer fraud can occur in many ways, but they all involve tricking people into sending money to scammers. For example, a common real estate wire fraud scheme is where criminals impersonate real estate agents or title companies and send fraudulent wiring instructions to homebuyers, telling them to wire their down payment or closing funds to the scammers’ accounts instead of the legitimate ones.

Sora / Pexels / If you are looking to recover funds from wire transfer fraud, make sure you understand what it actually is.

Another example is when fraudsters send fake email notifications or invoices from banks, utilities, or other service providers. Thereby, telling victims that they owe a certain amount of money and providing a link to a fraudulent payment page.

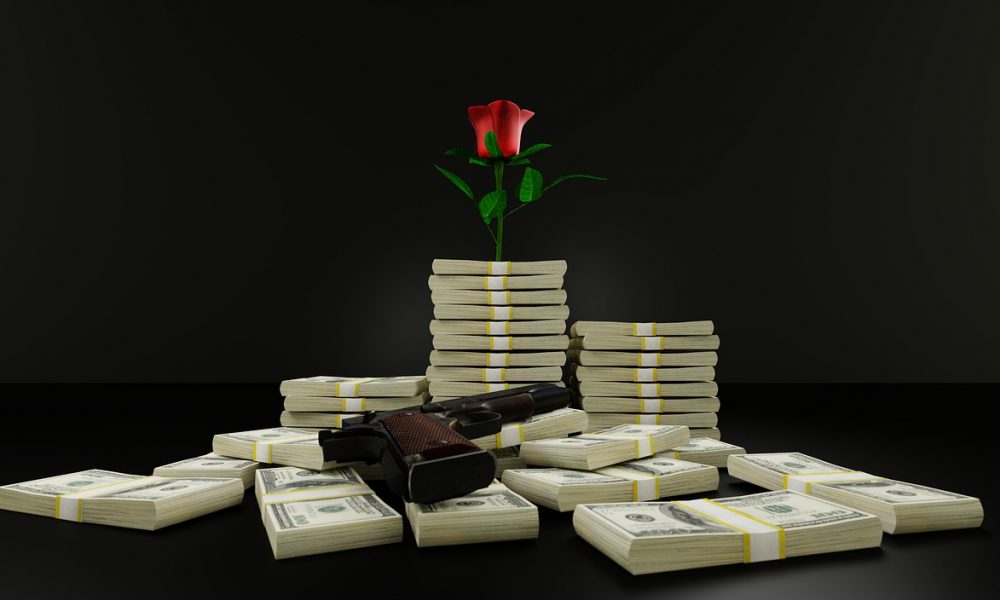

What Can You Do to Recover Your Funds?

If you are a victim of wire transfer fraud, the first thing you should do is contact your bank or wire transfer service provider and report the fraud. They may be able to reverse the transaction. Or, freeze the money before it reaches the scammer’s account, depending on how quickly you act.

You should also file a complaint with the FBI’s Internet Crime Complaint Center (IC3) and your local law enforcement agency And provide them with any evidence you have, such as emails, wire instructions, and receipts.

GTN / The moment you feel you are becoming a victim of wire transfer fraud, contact your bank immediately.

Additionally, you can report the fraud to the Federal Trade Commission (FTC) and credit reporting agencies to protect your credit score and prevent identity theft. Finally, you may want to consult a wire transfer fraud attorney. This professional will help you pursue legal action against the fraudsters and recover your losses.

The Final Word

Wire transfer fraud is a serious crime that can cause financial losses and emotional distress to victims. However, there are ways you can protect yourself from wire transfer fraud.

If you fall victim to wire transfer fraud, do not panic. Instead, act quickly to report the fraud and recover your funds. Remember, prevention is the best defense against wire transfer fraud. So, stay vigilant and informed about the latest scams and security measures.

More in Criminal Attorney

-

New York to Mail Out One-Time Inflation Rebates. Here’s the Eligibility List

New York is preparing to send out its first-ever inflation refund checks, providing financial relief to millions of residents as prices...

October 3, 2025 -

Here’s What Artists Should Know About Copyright & Its Implications

Copyright protects your art from the moment you create it. The second your drawing, painting, sculpture, or photo is fixed in...

September 27, 2025 -

Everything to Know About Vogue America’s New Editor, Chloe Malle

Chloe Malle just stepped into one of the most powerful roles in fashion media: Head of Editorial Content at Vogue America....

September 21, 2025 -

Did Barron Trump Apply to Harvard? Clearing Up the Rumors

Speculation often swirls around public figures, and in recent months Barron Trump’s college choices became part of the conversation. Questions surfaced...

September 20, 2025 -

Can You Be Naked in Texas?

The Texas public nudity law isn’t as simple as “no clothes, you are in trouble.” It all comes down to intent,...

September 13, 2025 -

Why AI Is Now a Necessity, Not a Choice, for Law Firms

Artificial intelligence is no longer a futuristic concept for the legal industry. It is steadily changing how law firms operate, not...

September 13, 2025 -

Waikiki Lifeguard Cleared in Confrontation With Notorious Criminal

On a hot day at Kuhio Beach, veteran lifeguard Christopher Kekaulike Kam stepped in when things got out of control. A...

August 13, 2025 -

Gawking at the Coldplay ‘Kiss Cam’ Affair Is Voyeurism at Its Worst!

Coldplay concerts are meant to be joyful. But during a recent show, a playful kiss cam bit turned into a public...

August 6, 2025 -

Essential Safety and Success Resources for Trans Journalists

Trans journalists go through tough spaces every day. In a field that often tests your limits, knowing where to turn for...

July 30, 2025