Shakira’s $15 Million Spanish Tax Fraud Case Settlement

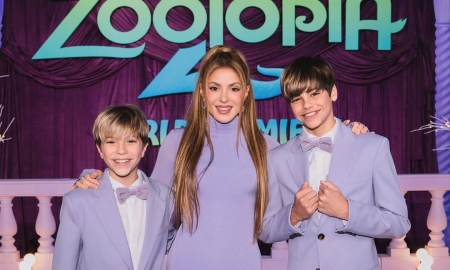

In a stunning turn of events, global pop sensation Shakira found herself at the center of a high-stakes legal drama in Barcelona, Spain. The Colombian singer, known for her electrifying performances and worldwide hits, faced a daunting challenge far removed from the glitz of the music world: a tax fraud trial with the potential of grave consequences like a prison sentence.

Shakira / IG / In a shocking twist, Shakira said “yes” confirming she failed to pay the Spanish government $15.8 million in taxes between 2012 and 2014.

Almost a decade ago, Shakira vehemently maintained her innocence in the face of allegations that she failed to pay $15.8 million in taxes to the Spanish government. The case centered around the period between 2012 and 2014. A time when her global fame was at its zenith.

Spanish authorities contended that Shakira had been living in Spain for more than half a year. A key factor in determining tax residency, and thus owed a substantial amount in taxes.

The Trial Begins: Tensions and Expectations

November 20 marked the opening day of Shakira’s trial in Barcelona. An event that captured the attention of both her fans and the media worldwide. The potential consequences were severe: If found guilty, the singer could face a significant prison sentence.

Shakira / IG / If Shakira had not settled the tax fraud case with the Spanish government, she would have faced a potential prison sentence.

The stage was set for a legal showdown, with the world watching to see how one of its most beloved entertainers would fare against a formidable judicial adversary.

A Last-Minute Twist: The Deal

In a dramatic twist, just as the trial commenced, news broke that Shakira had agreed to a last-minute deal with the prosecution. This decision marked a radical departure from her long-held stance of innocence. The deal, as reported by the Associated Press, involved Shakira accepting six counts of tax fraud and agreeing to a settlement with significant financial implications.

Under the terms of the agreement, Shakira would receive a suspended three-year sentence, avoiding jail time but acknowledging her wrongdoing. Additionally, she agreed to pay a $7.6 million fine, a substantial amount but arguably a more manageable outcome compared to the potential consequences of a guilty verdict in a full trial.

Shakira’s Response: A Reluctant Admission

In a moment charged with emotion and gravity, Shakira stood before Magistrate José Manuel del Amo and confirmed her acceptance of the deal. By answering “yes” to the charges, she publicly acknowledged her failure to pay the due taxes. A moment that undoubtedly marked a significant chapter in her life and career.

The conclusion of Shakira’s tax trial raises several questions and considerations. Firstly, it highlights the intense scrutiny that celebrities face in their financial dealings, a reminder that fame does not exempt one from legal and fiscal responsibilities.

Shakira / IG / “I need to move past the stress,” Shakira told news outlets after making the settlement.

Secondly, it underscores the complexities of international tax law. Particularly, for individuals with global incomes and residences.

Shakira’s Career: Resilience in the Face of Adversity

Throughout her career, Shakira has demonstrated remarkable resilience, overcoming various challenges to remain a dominant figure in the music industry. This trial, while a significant hurdle, is unlikely to diminish her star power or her connection with her millions of fans around the world.

More in Criminal Attorney

-

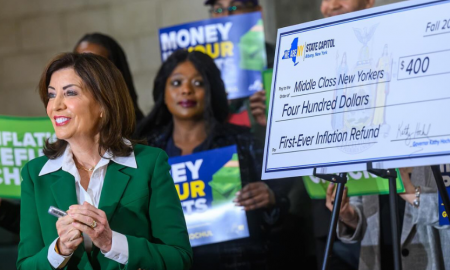

New York to Mail Out One-Time Inflation Rebates. Here’s the Eligibility List

New York is preparing to send out its first-ever inflation refund checks, providing financial relief to millions of residents as prices...

October 3, 2025 -

Here’s What Artists Should Know About Copyright & Its Implications

Copyright protects your art from the moment you create it. The second your drawing, painting, sculpture, or photo is fixed in...

September 27, 2025 -

Everything to Know About Vogue America’s New Editor, Chloe Malle

Chloe Malle just stepped into one of the most powerful roles in fashion media: Head of Editorial Content at Vogue America....

September 21, 2025 -

Did Barron Trump Apply to Harvard? Clearing Up the Rumors

Speculation often swirls around public figures, and in recent months Barron Trump’s college choices became part of the conversation. Questions surfaced...

September 20, 2025 -

Can You Be Naked in Texas?

The Texas public nudity law isn’t as simple as “no clothes, you are in trouble.” It all comes down to intent,...

September 13, 2025 -

Why AI Is Now a Necessity, Not a Choice, for Law Firms

Artificial intelligence is no longer a futuristic concept for the legal industry. It is steadily changing how law firms operate, not...

September 13, 2025 -

Waikiki Lifeguard Cleared in Confrontation With Notorious Criminal

On a hot day at Kuhio Beach, veteran lifeguard Christopher Kekaulike Kam stepped in when things got out of control. A...

August 13, 2025 -

Gawking at the Coldplay ‘Kiss Cam’ Affair Is Voyeurism at Its Worst!

Coldplay concerts are meant to be joyful. But during a recent show, a playful kiss cam bit turned into a public...

August 6, 2025 -

Essential Safety and Success Resources for Trans Journalists

Trans journalists go through tough spaces every day. In a field that often tests your limits, knowing where to turn for...

July 30, 2025