The Rise and Fall of Sam Bankman-Fried: Was It Just Business or Betrayal?

Sam Bankman-Fried, a name synonymous with cryptocurrency’s meteoric rise, now finds himself at the center of a legal whirlwind. His brainchild, FTX, once the world’s darling exchange, collapsed in a spectacular implosion, leaving billions of dollars in losses and thousands of investors questioning everything they thought they knew about the crypto wunderkind.

But was it all a calculated scheme or simply a case of bad bets and unfortunate circumstances? As Bankman-Fried’s trial unfolds, the lines between business acumen and alleged fraud blur, leaving us with a story as captivating as the volatile world of cryptocurrency itself.

From Prodigy to Pariah

Instagram | mosheh | Bankman-Fried, an unassuming MIT grad, was the crypto golden boy.

Just four years ago, Bankman-Fried, a brilliant but unassuming MIT grad, was the golden boy of crypto. His exchange, FTX, grew at an exponential rate, fueled by his vision of a more inclusive and accessible financial system. He hobnobbed with celebrities, inked million-dollar sponsorships, and even earned the nickname “Mr. Fix” for his attempts to bail out struggling crypto companies.

But cracks began to appear in the seemingly perfect facade. Whispers of interconnected entities, risky trading practices, and opaque financial dealings swirled around FTX. Then, in November 2022, the dam broke. A liquidity crisis exposed a web of alleged wrongdoings, sending shockwaves through the crypto ecosystem and plunging FTX into bankruptcy.

The Prosecution’s Case

Prosecutors paint a picture of calculated deception. They allege that Bankman-Fried, far from being a naive entrepreneur, orchestrated a deliberate scheme to divert customer funds to his hedge fund, Alameda Research.

They point to suspicious transactions, hidden code, and lavish spending as evidence of his malicious intent. “He wasn’t just playing fast and loose with the rules,” the prosecution charges, “he was bending them to his will, enriching himself at the expense of countless investors.”

The Defense’s Counter

Freepik | wirestock | Crypto market’s is inherent volatility, where losses are as frequent as gains.

Bankman-Fried’s defense paints a contrasting narrative. They argue that his actions, while perhaps flawed, were driven by a genuine belief in the potential of crypto and a desire to build a revolutionary financial platform.

They emphasize the inherent volatility of the crypto market, where losses are just as common as gains. “FTX was playing a high-stakes game, and unfortunately, they lost,” says Bankman-Fried’s attorney, Mark Cohen. “But losing a risky bet doesn’t make it a crime.”

Beyond the Black and White

The truth, as it often does, lies somewhere in the murky space between these opposing narratives. Was Bankman-Fried a visionary leader pushed too far by the unforgiving nature of the crypto market or a cunning manipulator who exploited a nascent system for personal gain? Did he simply make bad business decisions, or did he cross the line into criminal intent?

Key Questions That Will Shape the Verdict

Instagram | alphaofcrypto | Was FTX transparent or did it operate in secrecy regarding its financial dealings.

- Transparency vs. Secrecy: Was FTX truly transparent about its financial dealings, or did it operate in the shadows, allowing for potential manipulation?

- Intent vs. Negligence: Did Bankman-Fried knowingly divert funds for personal gain, or were his actions the result of recklessness and poor judgment?

- Regulation vs. Innovation: Does this case highlight the need for tighter regulation in the crypto space or stifle the innovation that drives its growth?

A Turning Point for Crypto’s Future

The FTX saga is far from over. As the trial unfolds, the world watches with bated breath, waiting for a verdict that could have far-reaching implications. Will Bankman-Fried be found guilty, sending a chilling message to the crypto industry?

Or will he be acquitted, leaving the question of his culpability unanswered and the future of crypto regulation hanging in the balance? One thing is certain: the FTX saga is a cautionary tale, a stark reminder of the risks and rewards inherent in the ever-evolving world of cryptocurrency.

More in Criminal Attorney

-

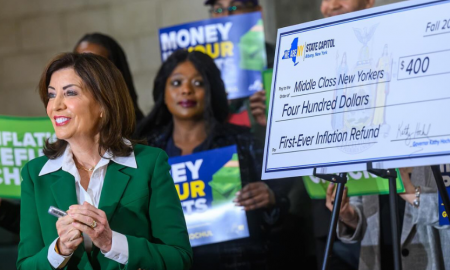

New York to Mail Out One-Time Inflation Rebates. Here’s the Eligibility List

New York is preparing to send out its first-ever inflation refund checks, providing financial relief to millions of residents as prices...

October 3, 2025 -

Here’s What Artists Should Know About Copyright & Its Implications

Copyright protects your art from the moment you create it. The second your drawing, painting, sculpture, or photo is fixed in...

September 27, 2025 -

Everything to Know About Vogue America’s New Editor, Chloe Malle

Chloe Malle just stepped into one of the most powerful roles in fashion media: Head of Editorial Content at Vogue America....

September 21, 2025 -

Did Barron Trump Apply to Harvard? Clearing Up the Rumors

Speculation often swirls around public figures, and in recent months Barron Trump’s college choices became part of the conversation. Questions surfaced...

September 20, 2025 -

Can You Be Naked in Texas?

The Texas public nudity law isn’t as simple as “no clothes, you are in trouble.” It all comes down to intent,...

September 13, 2025 -

Why AI Is Now a Necessity, Not a Choice, for Law Firms

Artificial intelligence is no longer a futuristic concept for the legal industry. It is steadily changing how law firms operate, not...

September 13, 2025 -

Waikiki Lifeguard Cleared in Confrontation With Notorious Criminal

On a hot day at Kuhio Beach, veteran lifeguard Christopher Kekaulike Kam stepped in when things got out of control. A...

August 13, 2025 -

Gawking at the Coldplay ‘Kiss Cam’ Affair Is Voyeurism at Its Worst!

Coldplay concerts are meant to be joyful. But during a recent show, a playful kiss cam bit turned into a public...

August 6, 2025 -

Essential Safety and Success Resources for Trans Journalists

Trans journalists go through tough spaces every day. In a field that often tests your limits, knowing where to turn for...

July 30, 2025