Coronavirus has Damaged Your Finances- Here’s How You can Keep Afloat in these Difficult Times

Coronavirus has been the unprecedented doom of the entire world economy. It has taken lives and livelihoods both. While many succumbed to death in the face of this tragedy, those who survived are left facing the desolation. Their jobs are either lost or their work hours are reduced, the stock market has crashed, and the interest rates moved to record lows.

Unsplash | The financial situation of all Americans has turned miserable

For this reason, Dan Ariely, a behavioral economist, and a renowned author, has patterned out two lists to help you assess your expenses in these troubled times and maximize utility in a budget. According to him, the coronavirus crisis is here to stay, and it will be long before the economy recovers and bounces back to the pre-pandemic market boom.

Why should you fine-tune your saving patterns?

According to Ariely, it is crucial to manage your savings right now before the worst befalls. That means cutting down on unnecessary expenditures so that your limited income lasts long. However, he does acknowledge the fact that it is not precisely possible to leave your savings untouched.

In fact, savings are the cushion to shield you in times of extreme need. You may withdraw your savings if your income dries out but, draw it out wisely to last you as long as the crisis takes to abate. In case, you get a bonus income or some financial assistance, replenish your savings accounts instead of spreading it on luxuries. Tough times call for harsh decisions, even if it means sacrificing on your wants.

Two lists to scrutinize your expenditure:

Stated below are the two lists recommended by Ariely to cut down on your spending in the short and long run.

1. All you can do without

This list will closely incorporate all the expenses that were undertaken for reasons other than personal gratification. Sometimes the status quo forces you to enlist yourself with unnecessary subscriptions while other times, a catchy advertisement forces you into making irrational purchasing decisions.

Now, it is critical to wisely assess the products that have stopped giving you utility and strike them out of your next month’s budget. Also, delay house renovations until things normalize.

Unsplash | The unneeded house expenditures can wait

2. All you have to do without

Make another list for a rain check. If things turn worse, and your financial strings get tighter, there is a list of things you can do without. Make a compilation for such a list beforehand so that when trouble does occur, you have an emergency course of action and can avoid undue stress.

This list may include expenditure on expensive processed food, chocolates, cable subscriptions, snack items, etc. Likewise, reduce unnecessary lighting on the porch, avoid taking long car rides for leisure, etc. Such small sacrifices steps can efficiently reduce your monthly monetary load.

Unsplash | Save money by cutting down on unnecessary grocery list items

After all, these small cuttings can result in significant savings.

More in Legal Advice

-

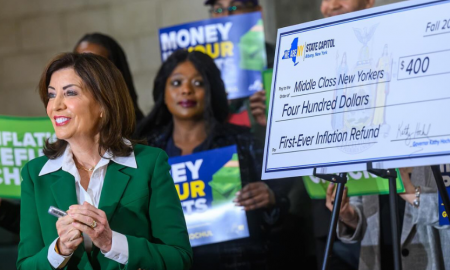

New York to Mail Out One-Time Inflation Rebates. Here’s the Eligibility List

New York is preparing to send out its first-ever inflation refund checks, providing financial relief to millions of residents as prices...

October 3, 2025 -

Here’s What Artists Should Know About Copyright & Its Implications

Copyright protects your art from the moment you create it. The second your drawing, painting, sculpture, or photo is fixed in...

September 27, 2025 -

Everything to Know About Vogue America’s New Editor, Chloe Malle

Chloe Malle just stepped into one of the most powerful roles in fashion media: Head of Editorial Content at Vogue America....

September 21, 2025 -

Did Barron Trump Apply to Harvard? Clearing Up the Rumors

Speculation often swirls around public figures, and in recent months Barron Trump’s college choices became part of the conversation. Questions surfaced...

September 20, 2025 -

Can You Be Naked in Texas?

The Texas public nudity law isn’t as simple as “no clothes, you are in trouble.” It all comes down to intent,...

September 13, 2025 -

Why AI Is Now a Necessity, Not a Choice, for Law Firms

Artificial intelligence is no longer a futuristic concept for the legal industry. It is steadily changing how law firms operate, not...

September 13, 2025 -

Waikiki Lifeguard Cleared in Confrontation With Notorious Criminal

On a hot day at Kuhio Beach, veteran lifeguard Christopher Kekaulike Kam stepped in when things got out of control. A...

August 13, 2025 -

Gawking at the Coldplay ‘Kiss Cam’ Affair Is Voyeurism at Its Worst!

Coldplay concerts are meant to be joyful. But during a recent show, a playful kiss cam bit turned into a public...

August 6, 2025 -

Essential Safety and Success Resources for Trans Journalists

Trans journalists go through tough spaces every day. In a field that often tests your limits, knowing where to turn for...

July 30, 2025